Financial Emergency Measures in the Public Interest Act 2015

|

Amendment of Act of 2010 | ||

|

6. (1) The Act of 2010 is amended by— | ||

(a) in section 1, the substitution of the following definition for the definition of “aggregation of public service pensions”: | ||

“ ‘aggregation of public service pensions’ means the aggregation under subsection (3) of section 2 or subsection (5) of section 2A of two or more public service pensions payable to a pensioner for the purposes of the application of subsection (1) or (2) of section 2 or subsection (3) of section 2A, as the case may be, in relation to the pensioner;”, and | ||

(b) the substitution of the following section for section 2: | ||

“Reduction in public service pension | ||

2. (1) The annualised amount of a public service pension payable in accordance with his or her entitlement to a person who— | ||

(a) is a pensioner, or | ||

(b) becomes a pensioner on or at any time before the relevant date or, in the case of a pensioner falling under paragraph (c) of the definition of “pensioner” in section 1, at any time after that date, | ||

where the annualised amount payable is not more than €34,132 shall be reduced— | ||

(i) with effect on and from 1 January 2016 and subject to subparagraphs (ii) and (iii), in accordance with Table A to this subsection, | ||

(ii) with effect on and from 1 January 2017 and subject to subparagraph (iii), in accordance with Table B to this subsection, and | ||

(iii) with effect on and from 1 January 2018, in accordance with Table C to this subsection. | ||

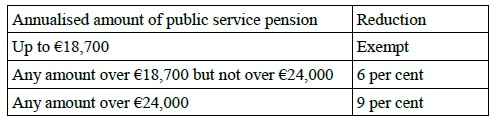

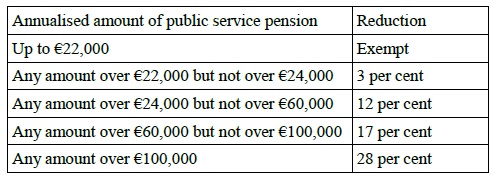

TABLE A | ||

| ||

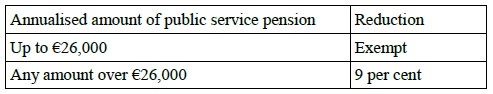

TABLE B | ||

| ||

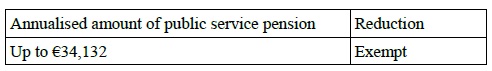

TABLE C | ||

| ||

(2) The annualised amount of a public service pension payable in accordance with his or her entitlement to a person who— | ||

(a) is a pensioner, or | ||

(b) becomes a pensioner on or at any time before the relevant date or, in the case of a pensioner falling under paragraph (c) of the definition of “pensioner” in section 1, at any time after that date, | ||

where the annualised amount payable is greater than €34,132 shall be reduced— | ||

(i) with effect on and from 1 January 2016 and subject to subparagraphs (ii) and (iii), in accordance with Table A to this subsection, | ||

(ii) with effect on and from 1 January 2017 and subject to subparagraph (iii), in accordance with Table B to this subsection, and | ||

(iii) with effect on and from 1 January 2018, in accordance with Table C to this subsection. | ||

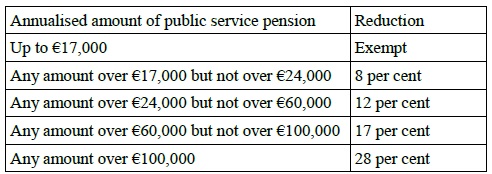

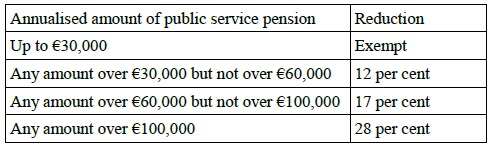

TABLE A | ||

| ||

TABLE B | ||

| ||

TABLE C | ||

| ||

(3) If— | ||

(a) two or more public service pensions are payable to a person, and | ||

(b) the annualised amount of all such pensions payable in accordance with the person’s entitlements exceeds €32,500, | ||

all such pensions shall be aggregated for the purposes of the application of subsections (1) and (2). | ||

(4) (a) Where the application to a pensioner of subsection (2) would result in the annualised amount of his or her public service pension being lower than would be the case if he or she had been on a pension specified in subsection (1) and that subsection applied to him or her, then subsection (2) shall be deemed to operate, in relation to that pensioner, in such a manner and by reference to the provisions of subsection (1) (the “relevant provisions”), as will result in his or her pension standing at the highest it would have stood at, as a result of that operation of subsection (2) by reference to the relevant provisions, had he or she been on whichever lower amount of pension produces the most beneficial result for him or her in consequence of the relevant provisions. | ||

(b) In this subsection a reference to a subsection or to the provisions of a subsection includes a reference to the Tables in that subsection. | ||

(5) Where a pension adjustment order has been made in relation to a public service pension, the annualised amount of the public service pension shall be reduced under this section before it is paid in accordance with the provisions of the pension adjustment order. | ||

(6) This section has effect notwithstanding— | ||

(a) any provision by or under— | ||

(i) any other enactment, | ||

(ii) any statute or other document to like effect of a university or other third level institution, | ||

(iii) any pension scheme or arrangement, | ||

(iv) any circular or instrument or other document, or | ||

(v) any written agreement or contractual arrangement, or | ||

(b) any verbal agreement, arrangement or understanding or any expectation. | ||

(7) In this section a reference to the annualised amount of a public service pension payable in accordance with a person’s entitlement is a reference to that entitlement not taking into account any reduction imposed by virtue of the operation of this Act whether as enacted or as amended by the Financial Emergency Measures in the Public Interest Act 2013 .”. | ||

(2) Section 5(3) of the Act of 2013 shall cease to have effect on and from 1 January 2016. |