S.I. No. 221/2015 - Companies Act 2014 (Section 682) Regulations 2015.

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 2nd June, 2015. | ||

I, RICHARD BRUTON, Minister for Jobs, Enterprise and Innovation, in exercise of the powers conferred on me by section 12 and 682 (2) of the Companies Act 2014 (No. 38 of 2014), hereby make the following regulations: | ||

1. These Regulations may be cited as the Companies Act 2014 (Section 682) Regulations 2015 and shall come into operation on 1 June, 2015. | ||

2. The form set out in the Schedule to these Regulations is hereby prescribed for the purposes of section 682 (2) of the Companies Act 2014 (No. 38 of 2014). | ||

SCHEDULE | ||

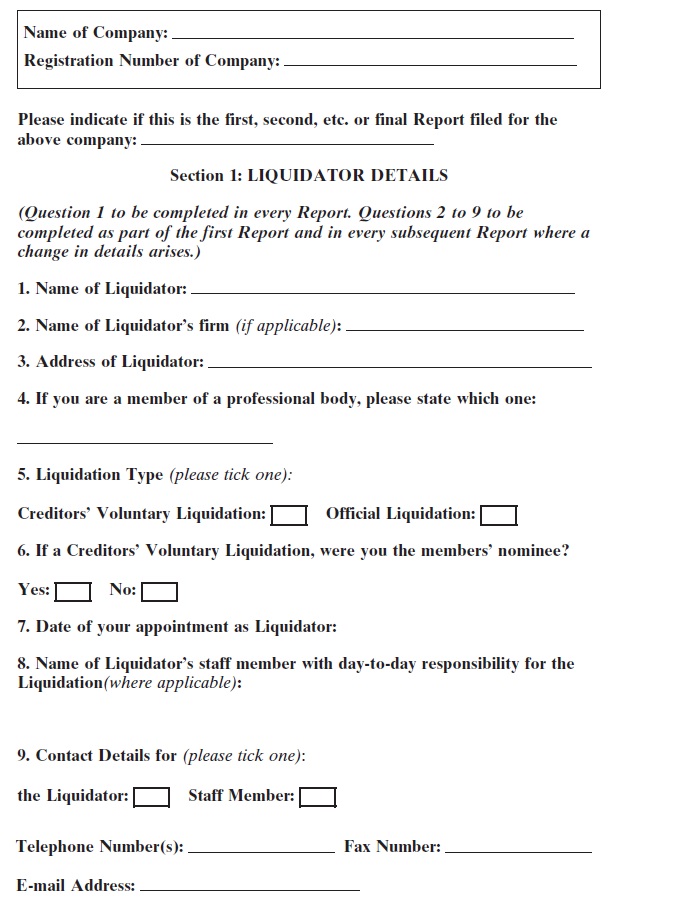

LIQUIDATOR’S REPORT UNDER SECTION 682 OF THE COMPANIES ACT 2014 | ||

Please refer to the Guidance Notes when completing this Report. These are available from the ODCE website at www.odce.ie/publications/decision.asp | ||

| ||

Section 2: COMPANY DETAILS | ||

(To be completed as part of the first Report and every subsequent Report where a change in details arises) | ||

10. Business/Trading Name(s) (please include all those used in the 12 months prior to the date of commencement of the winding up): | ||

| ||

| ||

| ||

11. Address of Current Registered Office: | ||

| ||

| ||

| ||

12. Address of any other Registered Office used in the 12 months prior to the date of commencement of the winding up: | ||

| ||

| ||

| ||

13. Principal Trading Address(es) (please include all those used in the 12 months prior to the date of commencement of the winding up, if different from the Registered Office(s) above): | ||

| ||

| ||

| ||

14. Nature of the Company’s Business: | ||

a. Please state the most relevant NACE Classification at the date of commencement of the liquidation (see Guidance Notes): | ||

| ||

b. Please give a precise description of the Company’s activities at the date of commencement of the liquidation: | ||

| ||

| ||

| ||

15. Number of Company employees at the date of commencement of the liquidation: ______________ | ||

16. Turnover for each of the last three financial years preceding the date of commencement of the liquidation: | ||

Financial Year Ended (date): ______________ Turnover: ______________ (€ amount) | ||

Financial Year Ended (date): ______________ Turnover: ______________ (€ amount) | ||

Financial Year Ended (date): ______________ Turnover: ______________ (€ amount) | ||

17. Trading Details (please state as a minimum month and year): | ||

a. Date of Commencement of Trading: ______________ | ||

b. Date of Cessation of Trading (if applicable): ______________ | ||

18. Please state, in your opinion, the reasons for the liquidation of the Company, and cite the evidence to support this opinion on a separate sheet. | ||

19. Has there been any Scheme of Arrangement/Receivership/Examinership/Liquidation in the Company in the 36 months prior to the date of this report- | ||

| ||

If yes, please provide relevant information, including type, name and address of any office-holder(s), date(s) of appointment/termination of appointment, copies of all notices of appointment and reports of receivers/examiners/liquidators or other office holders of the Company during that period: | ||

| ||

| ||

| ||

| ||

| ||

20. Is there a deficiency in any tax return or payment of taxes? | ||

| ||

If so, please specify the periods, if any, for which returns are overdue and/or the amounts due. Please also specify the amounts paid in respect of those periods. (please attach to this Report a copy of the Revenue Statement of Collections and Payments that issued to you upon your appointment as liquidator. If not attached, please state why not.). | ||

| ||

| ||

| ||

| ||

21. Have you any information which may lead you to believe that there was a person acting as a shadow director of the Company- (Please note that the expression ‘shadow director’ may include an individual or a body corporate): | ||

| ||

If yes, please provide the following details for the individual/body corporate in question: | ||

a. Full Name: ______________ | ||

b. Current or last known address: | ||

| ||

| ||

c. What was the Person’s role in the Company? ______________ | ||

d. Has the Person demonstrated to you that s/he has acted honestly and responsibly in relation to the conduct of the Company’s affairs? | ||

| ||

Please provide on a separate sheet details of the factors which support this answer and any other relevant information. | ||

Section 3: COMPANY DIRECTORS | ||

(To be completed as part of the first Report and every subsequent Report where a change in details arises) | ||

22. In this Section, you are required to include every person who appears to you to be, or have been, a director of the Company at the date of commencement of the winding up or at any time in the 12 months prior to the date of commencement of the winding up. | ||

A separate copy of this Section should be used for each Person. | ||

a. Full name (including other known names): | ||

b. Current or last known address: | ||

| ||

c. Date of birth: | ||

d. Period as director: | ||

From (date): ____________ To (date): ____________ | ||

e. What was the Person’s role in the Company? | ||

| ||

f. Has the Person demonstrated to you that s/he has acted honestly and responsibly in relation to the conduct of the Company’s affairs? | ||

| ||

Please provide on a separate sheet details of the factors which support this answer. | ||

h. Other Directorships (please provide full details of present/past companies of which this Person is/was a Director in the period from 12 months prior to the date of commencement of the winding up of the Company to date and include the company registration number, the date(s) of appointment/termination of the period as Director in each case and please indicate if any of these companies operated in a sector similar to the Company in liquidation): | ||

| ||

| ||

| ||

| ||

Section 4: STATEMENT OF AFFAIRS, ACCOUNTS AND REPORT TO CREDITORS | ||

(To be completed as part of the first Report and every subsequent Report where a change in details arises) | ||

23. Directors’ Statement of Affairs or similar document (please attach a copy to this Report. If a copy is not attached, please state why not and attach details of the known assets and liabilities of the Company): | ||

| ||

| ||

| ||

24. Is there a material difference between the Statement of Affairs or similar document and the expected final position? | ||

| ||

If so, please provide details of the amount and the reason for this material difference on a separate sheet. | ||

25. Audited/Other Accounts (please attach to this Report a copy of the last two sets of the audited accounts of the Company and the most recent draft or management accounts prepared after the last set of audited accounts. If the Company is exempted from audit, please provide a copy of the accounts laid before the AGM for the same period and the most recent draft or management accounts. If none are attached, please state why not.): | ||

| ||

| ||

| ||

26. Report to Creditors and any other relevant material, e.g., minutes of creditors’ meeting and Chairperson’s statement to meeting (please attach these documents and if they are not available, state why not): | ||

| ||

| ||

| ||

27. Has a Committee of Inspection been appointed? | ||

| ||

If so, please provide the names and addresses of the members: | ||

| ||

| ||

| ||

28. Will the winding up be completed within 18 months from the date of this report? | ||

| ||

29. Was there any material transfer of assets of the Company (see Guidance Notes) to any person during the period commencing 12 months prior to the date of commencement of its winding up and ending on the date of this report? | ||

| ||

If yes, please provide details, e.g., date(s) of transfer, nature of asset(s), beneficiary(ies), on a separate sheet. | ||

30. On what date was the Company unable to trade out of its financial difficulties? ______________ | ||

Section 5: PROCEEDINGS | ||

(To be completed as part of the first Report and every subsequent Report where a change in details arises) | ||

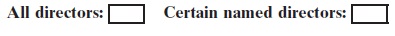

31. Are you asking the Director of the Office of Corporate Enforcement at this time to relieve you from the requirement to apply, pursuant to section 683 of the Companies Act 2014 , for the restriction of one or more of the directors of the Company? | ||

| ||

If yes, is relief being sought for-, (please tick one) | ||

| ||

In either case, please name each director for which relief is sought and state the grounds upon which you consider that an application for restriction should not now be taken against each individual. | ||

| ||

| ||

In respect of any remaining directors, please name them and indicate the grounds upon which the application for restriction will be made in each case: | ||

| ||

| ||

32. In respect of this Company will you be applying to the High Court to disqualify any person, pursuant to section 842 of the Companies Act 2014 ? | ||

| ||

If yes, please name the person(s) in question and indicate the grounds upon which the application to disqualify will be taken: | ||

| ||

| ||

| ||

33. Are any other proceedings being undertaken, or contemplated, by you against officers of the Company? | ||

| ||

If yes, please specify the nature of the proceedings, the person(s) against whom the proceedings are being or may be taken and the date/expected date of commencement of the proceedings. If proceedings have commenced please state whether they are in the High Court or Circuit Court and cite the Court record number of the case: | ||

| ||

| ||

34. Are any other civil or criminal proceedings being undertaken, or contemplated, by any other person against the Company or any of its officers? | ||

| ||

If yes, please specify the nature of the proceedings, the person(s) against whom the proceedings are being or may be taken, the date/expected date of commencement of the proceedings and the name, address and telephone number of the person taking or contemplating the proceedings. If proceedings have commenced, please state whether they are in the High Court or Circuit Court and cite the Court record number of the case: | ||

| ||

| ||

| ||

35. Have you made, or are you contemplating making, a report to the Director of Public Prosecutions and the Director of Corporate Enforcement under section 723 of the Companies Act 2014 ? | ||

| ||

If yes, please specify the nature of any suspected offence(s), the person(s) to whom the report relates, the relationship of each such person to the Company and the date/expected date of submission of the report: | ||

| ||

| ||

| ||

Section 6: FINAL REPORT | ||

36. Outcome of restriction application(s) to the High Court (if applicable) (please provide details for each person): | ||

| ||

| ||

37. Outcome of any other court proceedings taken under the circumstances set out in questions 32, 33 and 34: | ||

| ||

| ||

Section 7: Liquidators Statement | ||

(To be completed on every occasion a report is made) | ||

I, ______________, being the liquidator of the above company, state that the details and particulars contained in this Report and all associated documentation prepared by me are true, correct and complete, to the best of my knowledge and belief. | ||

Signed: ______________ | ||

Date: ______________ | ||

Please ensure that copies of the following are attached to this Report: | ||

• Separate sheets (if applicable) [items 18, 22(g), 24, 29]; | ||

• Copies of notices of appointment and reports of receivers/examiners/liquidators/other office-holders (if applicable) [item 19]; | ||

• A copy of the Revenue Statement of Collections and Payments that issued to you upon your appointment as liquidator. | ||

• Statement of Affairs (or details of assets and liabilities) [item 23]; | ||

• Last two sets of audited accounts and draft or management accounts subsequently prepared, if any [item 25]; | ||

• Report to Creditors and other relevant material, including minutes of creditors’ meeting, Chairperson’s statement to meeting [item 26]; | ||

• Additional copies of Section 3: Details of Company Directors; | ||

• Any further information or documentation that you deem to be required. | ||

| ||

GIVEN under my Official Seal, | ||

29 May 2015. | ||

RICHARD BRUTON, | ||

Minister for Jobs, Enterprise and Innovation. | ||

EXPLANATORY NOTE | ||

(This note is not part of the Instrument and does not purport to be a legal interpretation.) | ||

The purpose of these Regulations is to prescribe the form of the liquidators report for the purposes of section 682 (2) of the Companies Act 2014 . |